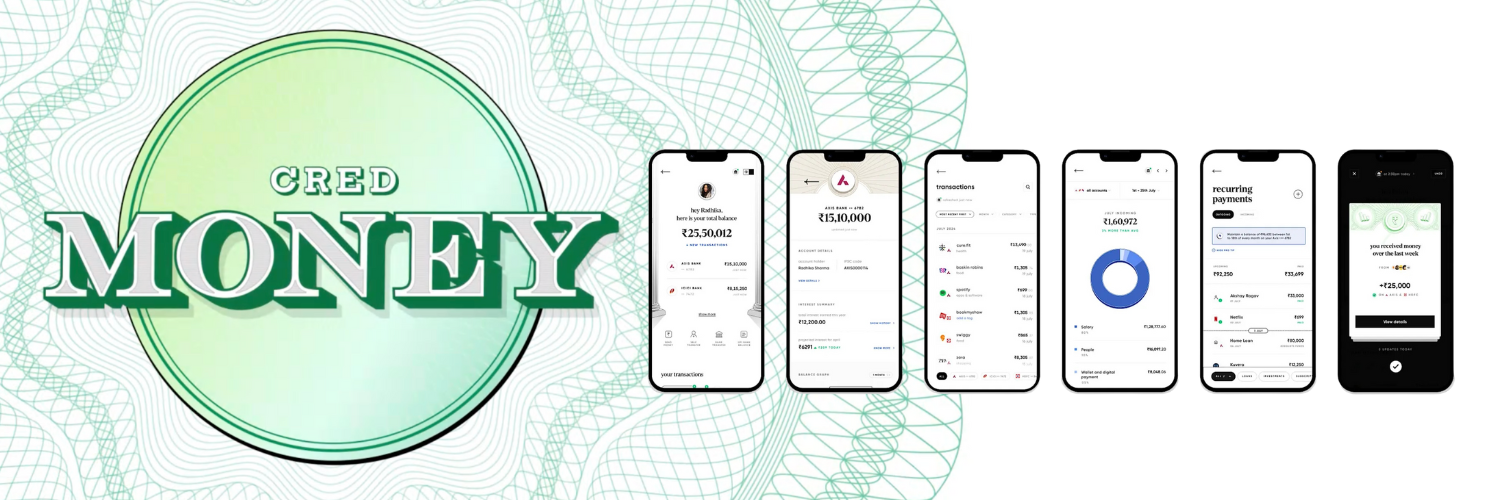

CRED, an Indian fintech startup valued at $6.4 billion, has launched CRED Money to help users better manage and understand their cash flow. Known for its credit card bill payment and consumer lending services, CRED now offers a comprehensive dashboard that consolidates financial data from all bank accounts. This feature allows users to track transactions and recurring payments, such as SIP investments, rent, and staff salaries, all in one place, with added reminders for important payments.

CRED Money utilizes India's account aggregator framework, introduced by the Reserve Bank of India, to enhance transparency and user control over financial information. This framework allows users to grant temporary, purpose-specific access to their financial data across multiple institutions through a standardized, encrypted channel.

The platform employs data science algorithms to analyze users' transactions, which average about 200 per month. It provides actionable insights on spending patterns and investment opportunities, helping users optimize their finances. Founder Kunal Shah said, "We have built a product that improves every affluent person’s relationship with money and makes them less anxious about it through a trusted, insightful experience."

CRED highlights that nearly 70% of India's affluent population struggles with fragmented finances across multiple platforms, which can lead to suboptimal decision-making and potentially impact credit scores.

CRED Money is rolling out in phases, starting Thursday, as part of the company's broader strategy to expand its portfolio. This expansion includes the recent acquisition of Kuvera, a platform for mutual fund and stock investments. CRED ensures that new features undergo extensive internal testing, with months of employee trials, before being released to customers. This approach ensures that only features demonstrating clear value reach its wider user base.