WeWork India, a leading flexible workspace provider, has successfully raised ₹500 crore through a rights issue. The capital infusion is set to bolster the company's financial health by repaying existing debt and reducing capital costs, steering it towards a debt-free status.

Utilization of Funds:

- Debt Repayment: The primary allocation of the ₹500 crore will be towards repaying existing debt, thereby strengthening the company's balance sheet.

- Cost Reduction: By reducing its debt obligations, WeWork India aims to lower its cost of capital, enhancing financial efficiency.

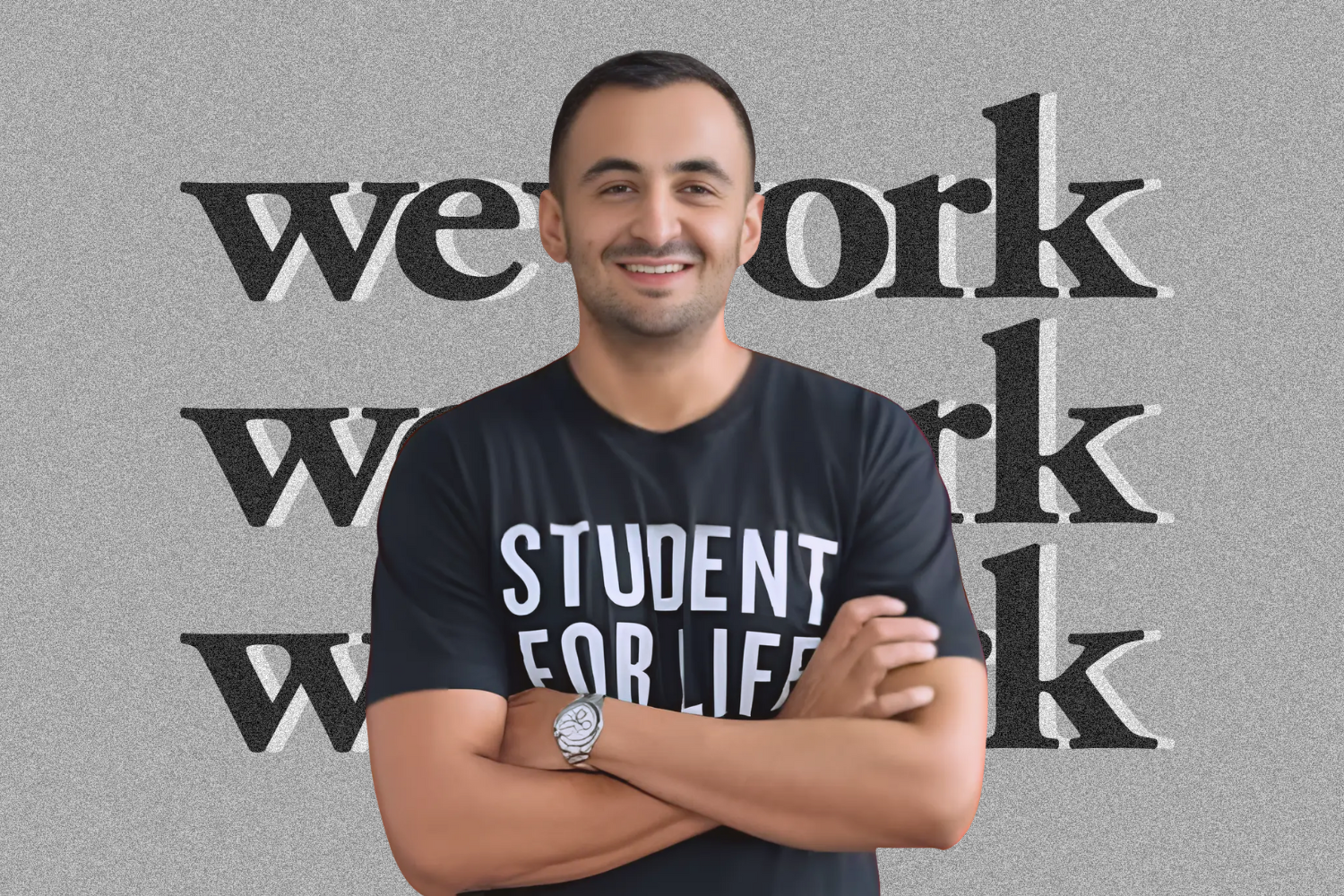

Leadership Perspective:

Karan Virwani, Managing Director & CEO of WeWork India, stated, "With the recent successful completion of our rights issue, we are on the path to being debt-free. This underscores the trust and confidence our investors/shareholders have in our vision and strategy in India.”

Company Background:

- Ownership Structure: WeWork India operates as an unlisted entity with Embassy Group holding a 73% stake and WeWork Global owning the remaining 27%.

- Operational Footprint: Since its inception in 2017, WeWork India has expanded to 63 operational centers across cities including Chennai, New Delhi, Gurugram, Noida, Mumbai, Bengaluru, Pune, and Hyderabad, offering over 100,000 desks.

Financial Performance:

- Revenue Growth: In the fiscal year ending March 2024, WeWork India reported a 22% increase in revenue to ₹1,737.2 crore.

- Profitability Metrics: The company's losses narrowed from ₹148.8 crore in FY23 to ₹132.5 crore in FY24, indicating improved financial performance.

Market Context:

The coworking sector in India has witnessed significant growth, driven by a dynamic startup ecosystem and increasing adoption by large corporations across various sectors. WeWork India's strategic move to become debt-free positions it favorably to capitalize on emerging opportunities in the flexible workspace market.

Our Opinion on the News:

WeWork India's successful ₹500 crore rights issue marks a pivotal step towards financial stability and operational growth. By focusing on debt repayment and cost reduction, the company is enhancing its financial health, which is crucial for sustaining long-term growth in the competitive coworking sector. This move not only reflects strong investor confidence but also positions WeWork India to effectively leverage emerging opportunities in the flexible workspace market, catering to the evolving needs of startups and large enterprises alike